In today's unpredictable financial landscape, bonds serve as a cornerstone for investors seeking stability and reliable income.

Mastering the bond market is about more than just debt securities; it's about building a resilient financial future through informed and strategic decisions.

This comprehensive guide will walk you through everything from fundamental principles to advanced tactics, empowering you to optimize your portfolio with confidence.

Whether you're a novice or seasoned investor, understanding bonds can lead to more predictable returns and enhanced financial security.

Let's dive into the essential concepts that form the backbone of bond investing.

Bonds are debt instruments where you lend money to issuers like governments or corporations.

In return, you receive regular interest payments, known as coupons, and the principal is repaid at maturity.

Typically issued at a standard par value of $1,000, bonds offer a fixed income stream that contrasts with the volatility of stocks.

This predictability makes them a key component of conservative investment strategies.

Several core elements define how bonds function and their appeal to investors.

Unlike equities, bonds do not grant ownership but prioritize payment in bankruptcy, offering a layer of security.

This senior claim in financial distress underscores their role as a safer asset class.

One of the most critical principles in bond markets is that bond prices and yields move inversely.

When interest rates rise, new bonds offer higher coupons, making existing bonds less attractive and driving prices down.

Conversely, in a falling rate environment, existing bonds with superior coupons become prized, pushing prices above par.

For example, a bond with a 3% coupon might trade at a premium if market rates drop to 2%.

Yield to Maturity (YTM) encapsulates the total return anticipated if held to maturity, factoring in all payments and price changes.

It serves as a comprehensive measure for comparing bonds, especially when purchased at discounts or premiums.

Understanding this dynamic is crucial for timing investments and assessing value in shifting markets.

Several factors influence how bond prices fluctuate, each playing a role in investment outcomes.

By monitoring these elements, investors can better predict price trends and make strategic purchases.

While bonds are generally lower-risk, they are not immune to challenges that can erode returns.

Diversification across issuers, maturities, and bond types is key to mitigating these risks.

The bond universe is diverse, catering to different investor profiles and objectives.

This spectrum allows for tailored portfolios that balance risk and return according to individual goals.

To optimize bond investments, advanced strategies focus on managing maturity and interest rate exposure.

These approaches transform basic bond holding into a dynamic component of your financial plan.

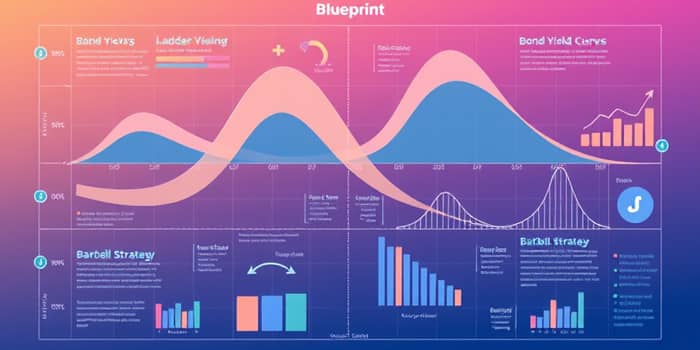

Bond ladders involve purchasing multiple bonds with different maturity dates, such as one maturing each year over a decade.

As each bond matures, the principal is reinvested in a new long-term bond, maintaining the ladder structure.

This strategy ensures a steady stream of income and reduces the impact of rate changes.

The barbell strategy combines short-term and long-term bonds, avoiding intermediate maturities.

It captures high yields from long bonds while using short bonds for flexibility to reinvest if rates move.

For example, an investor might allocate half to 1-year bonds and half to 20-year bonds.

The bullet strategy focuses on bonds maturing simultaneously, but purchases are made over time to average out price effects.

This is ideal for funding specific future expenses, like a child's education, by ensuring a lump sum is available.

By staggering buys, you minimize the risk of buying all bonds at a peak in rates.

Investors can access bonds through direct purchases or via funds, each with distinct advantages.

Assessing factors like credit ratings, maturity profiles, and tax implications is essential.

Consulting a financial advisor can guide these choices and help align investments with your goals.

In the post-2020 economic landscape, interest rate volatility has heightened, making bond strategies more relevant than ever.

Central bank policies and inflation trends continue to shape bond prices, requiring adaptive approaches.

For instance, in a rising rate environment, strategies like ladders or barbells can help lock in yields.

Looking ahead, investors should focus on diversification and maturity management to navigate potential shifts.

By staying informed and proactive, you can turn bond investing into a powerful tool for financial resilience.

Bonds are more than just debt instruments; they are a pathway to financial stability and growth.

From understanding the basics of pricing and yields to implementing advanced strategies, this blueprint equips you with knowledge.

Start by assessing your risk tolerance, explore the variety of bonds available, and consider strategic approaches.

With dedication and insight, you can build a bond portfolio that supports long-term goals and weathers uncertainties.

Let this guide inspire you to take control of your investments and harness the power of bonds.

References