In the relentless world of business, sustainability is the ultimate prize. Every company aspires to not just survive but thrive for decades, impervious to competitors. This aspiration is embodied in the powerful idea of an economic moat, a metaphor that has shaped investment wisdom and corporate triumphs globally.

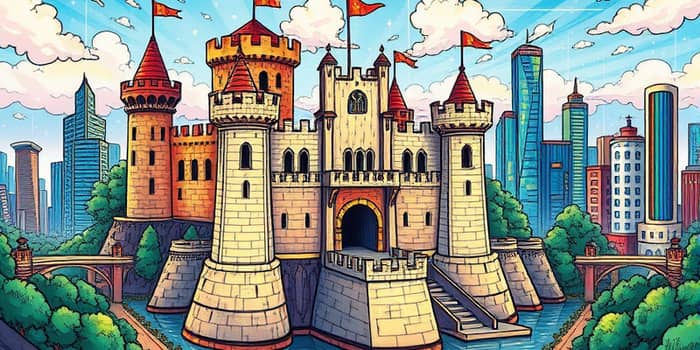

Popularized by legendary investor Warren Buffett, an economic moat represents a sustainable competitive advantage that shields a firm's profits and market share. Like a medieval castle's moat, it defends against rivals eager to capture success. Buffett has emphasized this concept over 20 times in Berkshire Hathaway letters, highlighting its role in long-term value creation.

Why does this matter for you? Whether you're an investor seeking resilient stocks or an entrepreneur building a startup, understanding and constructing a moat can be your key to enduring prosperity. It transforms fleeting wins into lasting legacies, enabling firms to maintain high profitability even in tough times. This article will guide you through identifying, building, and fortifying your own moat.

An economic moat is not a temporary edge but a durable barrier that keeps competitors at bay. Companies with wide moats can sustain advantages for 20 years or more, while narrow moats last at least a decade. Without a moat, advantages erode quickly, leaving businesses vulnerable to market shifts.

Buffett's insight is crucial here: focus on the durability of advantage. This perspective shifts from short-term gains to long-term sustainability, a principle vital for business strategy. It encourages looking beyond immediate profits to build something that endures.

Moats arise from a blend of internal and external factors. Internally, companies cultivate strengths that become formidable barriers. Externally, environmental conditions create natural protections. Let's explore the primary sources.

Internal factors are within a company's control and often form the core of a moat.

External factors can also contribute to moats, often from the business environment.

Seeing moats in action brings the concept to life. Consider these industry leaders and their strategies.

These examples show that moats are tangible drivers of success, not abstract ideas. They provide practical lessons for any business aiming to build similar defenses.

To identify a moat, look beyond surface metrics. Key indicators help gauge the strength and durability of advantages.

Financial metrics are critical for assessing moat effectiveness.

Non-financial factors are equally important for a comprehensive view.

Here's a table summarizing common moat sources and their benefits for quick reference.

Moats are not permanent; they can erode from external or internal threats. External factors include antitrust actions, deregulation, or tech disruptions that make models obsolete. Internally, neglect—like failing to reinvest in innovation—can weaken a moat.

To defend your moat, adopt a proactive approach. Focus on continuous adaptation and reinforcement.

Remember, a moat requires upkeep. Just as a castle's defenses need maintenance, businesses must regularly assess and strengthen their advantages to ensure longevity. This ongoing effort is key to sustaining competitive edges.

Whether starting a business or optimizing an existing one, here's a practical guide to constructing your moat. It blends analysis, action, and vigilance for lasting impact.

In startups, securing a moat early is essential for scaling. It helps establish a defensible position before competitors catch up. For established firms, reinvesting profits into moat-building activities—like Amazon's expansion—can turn narrow advantages into wide barriers.

The journey to building a moat is ongoing. It demands vigilance, creativity, and commitment. But the rewards are profound: not just survival, but dominance. As Buffett taught, focus on durability, and you'll create a legacy that stands the test of time.

Now, take action. Assess your business or investments through the lens of economic moats. Identify where to dig deeper and fortify weaknesses. Build a fortress that protects your dreams, ensuring enduring success in an ever-changing world.

References